50+ can i deduct mortgage payments on rental property

Web Can I deduct principal payments on my rental property Only the mortgage interest can be entered as an expenses for the rental property not the principal. Compare More Than Just Rates.

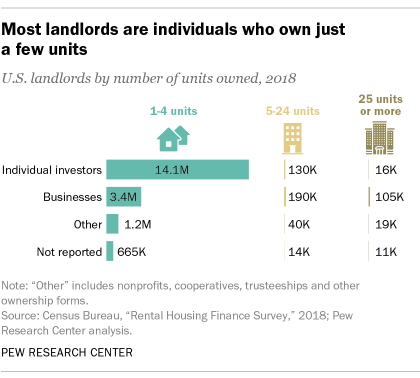

Who Rents And Who Owns In The U S Pew Research Center

Web Mortgage insurance premiums are tax-deductible as an expense incurred when renting out dwellings.

. Web Still you can deduct interest on up to 750000 1 million if you took out the mortgage before Dec. Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator. If you took out a 25.

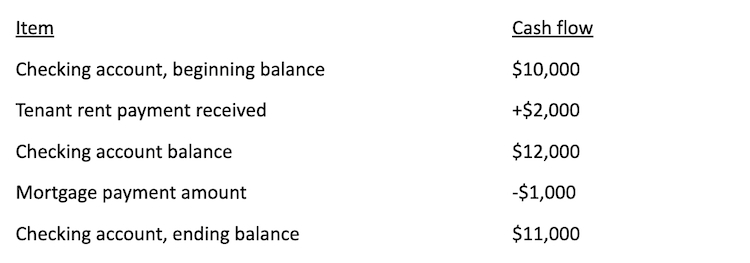

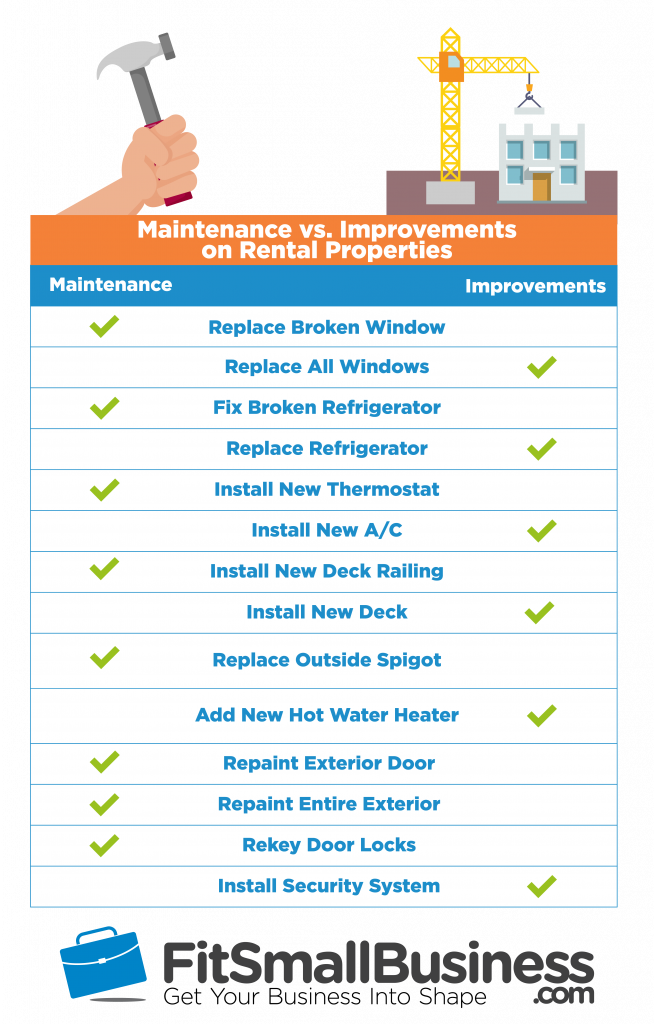

Web The mortgage payment is considered a capital contribution by you and your wife as partners. Web Interest is a significant long term expense so its reassuring that it will be balanced out with tax deductions. Web Repair costs utility bills property taxes and vehicle mileage are a few of the expenses a landlord can deduct to offset rental income.

16 2017 of secured mortgage debt on your first or second home. You cannot deduct principal mortgage payments from your income whether your real estate property is your primary residence or a rental. Web If your rental property produces 50000 in rental income for the year you can take a 15000 deduction for the mortgage interest which reduces your taxable rental.

Even if the mortgage-principal payments push your rental into the red the tax savings from writing off 25000 in expenses may make up for it. Lets take a look at an example. Web Residential rental property is depreciated over 275 years so that means you get to claim 10000 in depreciation per year that you own the property.

Web For the most part all of your rental property expenses can be deducted against your rental income including property taxes the cost of advertising. Web The short answer is no. You may not deduct payments of principalthat is.

Often the largest deduction a landlord. This transaction just skips the cash in and out of the LLC since you. Web Up to 25 cash back Remember that you only deduct the interest you pay on a loan to purchase or improve a rental property.

Web You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes of renting. Find A Lender That Offers Great Service. You can deduct the entire portion of this expense if the.

English Private Landlord Survey 2021 Main Report Gov Uk

Why Does Renting Cost Twice What A Mortgage Payment Does Quora

9 Steps To Prepare Your Home For An Appraisal

Tax Tips For Getting Your Best Refund As A Self Employed Contractor

Is A Rental Property Considered A Business What You Need To Know Rentprep

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

The Most Common Multiple Income Streams

Opp Magazine December 2013 By Opp Magazine Issuu

Is Your Mortgage Considered An Expense For Rental Property

English Private Landlord Survey 2021 Main Report Gov Uk

Is Your Mortgage Considered An Expense For Rental Property

Investing In Commercial Vs Residential Real Estate

Top 12 Rental Property Tax Deductions Benefits Free Worksheet

10 Most Expensive Tax Mistakes

Is Your Mortgage Considered An Expense For Rental Property

50 Sample Rental Proposal In Pdf Ms Word

:max_bytes(150000):strip_icc()/house-keys-and-contract-on-table-in-house-rental-1082558850-f4ceefa00b2f4b08b84c4ae77d17dd65.jpg)

The Tax Benefits Of Owning A Rental Property